27+ how to calculate ira basis

Opening an IRA May Help Meet Goals of Investing for Income or Growth. Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today.

What Is A Roth Ira Basis Complete Guide The Turbotax Blog

Handling cost basis for retirement accounts can be complex.

. Web Your basis is the amount of contributions in your Roth IRAs. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators.

Ad Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Web Calculating the Basis For example if you have a Roth IRA with 12000 and you contributed 10000 to it your tax basis is 10000. Web The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Non-deductible amount total of all. That 2000 investment income. The cost is the amount you pay for it in cash debt obligations and other property or services.

On smaller devices click in the upper left-hand corner then click Federal. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Our Expert Investment Professionals Aim To Maximize Returns And Strive To Manage Risk.

Click Retirement Plan Income in the. Web The basis of a Traditional IRA is the amount of non-deductible contributions you made to that IRA. The formula for tax purposes looks like this.

Web Your Taxable Account Deposit is equal to your Traditional IRA contribution minus any tax savings. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Web Finally subtract the tax-free portion from the old basis to find the remaining basis.

Web The basis is the total basis for all traditional IRA accounts combined. Web To calculate your profits for tax purposes youll need to subtract your cost basis for the five shares from the sale price of the five shares. Web To calculate the tax implications of a Roth IRA conversion you need to know your taxable income the amount you plan to convert and the tax rates for both.

As the IRA was a rollover from your 401k plan. The remaining 26320 28000 1680 is taxable in 2021. The year a Roth IRA was first established for your benefit.

Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. For a designated Roth account distribution. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Web Subtracting this from 1 gives 085 for the taxable portion of the account. Especially in New Jersey. Web Multiplying the ratio UVt times the amount of the distribution D determines the non-taxable portion of the distribution that is a partial return of the basis and the.

Web In most situations the basis of an asset is its cost to you. Calculating the taxable portion of IRA distributions for New Jersey gross. For example say you inherit a traditional IRA with a basis of 20000 and you.

Web TaxSlayer rounds the ratio of basis to IRA totals to 3 decimal places which can result in minor taxable amount and new basis amount errors. For example assume you have a 30 combined state and federal tax rate. If you decide to withdraw 10000 multiplying by 085 gives a taxable IRA withdrawal amount of.

Web From within your TaxAct return Online or Desktop click Federal. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. Theoretically your contribution account has a basis of 1250 and your rollover account.

150 x 5 - 100 x 5. Web Your Roth IRA balance at retirement is based on the factors you plug in to the calculator your total planned annual contribution your current age and retirement age and the rate. Web The IRS requires you to include the value of all your non-Roth IRAs as the basis.

Web The 1680 is the amount of tax-free basis included in your 2021 withdrawals.

How To Accurately Calculate Roth Ira Basis Silver Tax Group

How To Accurately Calculate Roth Ira Basis Silver Tax Group

Remember Your Ira Basis Scorecard When Planning Roth Ira Conversions Retirement Income Center

Does Cost Basis Matter In An Ira Budgeting Money The Nest

How Do I Calculate My Basis In My Ira For Irs Form 8606 Yqa 205 2 Youtube

Pdf Charge Exchange Excitation And Ionization In Slow Be4 H And B5 H Collisions Predrag Krstic Academia Edu

What Is Ira Basis

How To Build Wealth Buy Low And Sell High Consistently Seeking Alpha

Money Jan2017 By Egarel07 Issuu

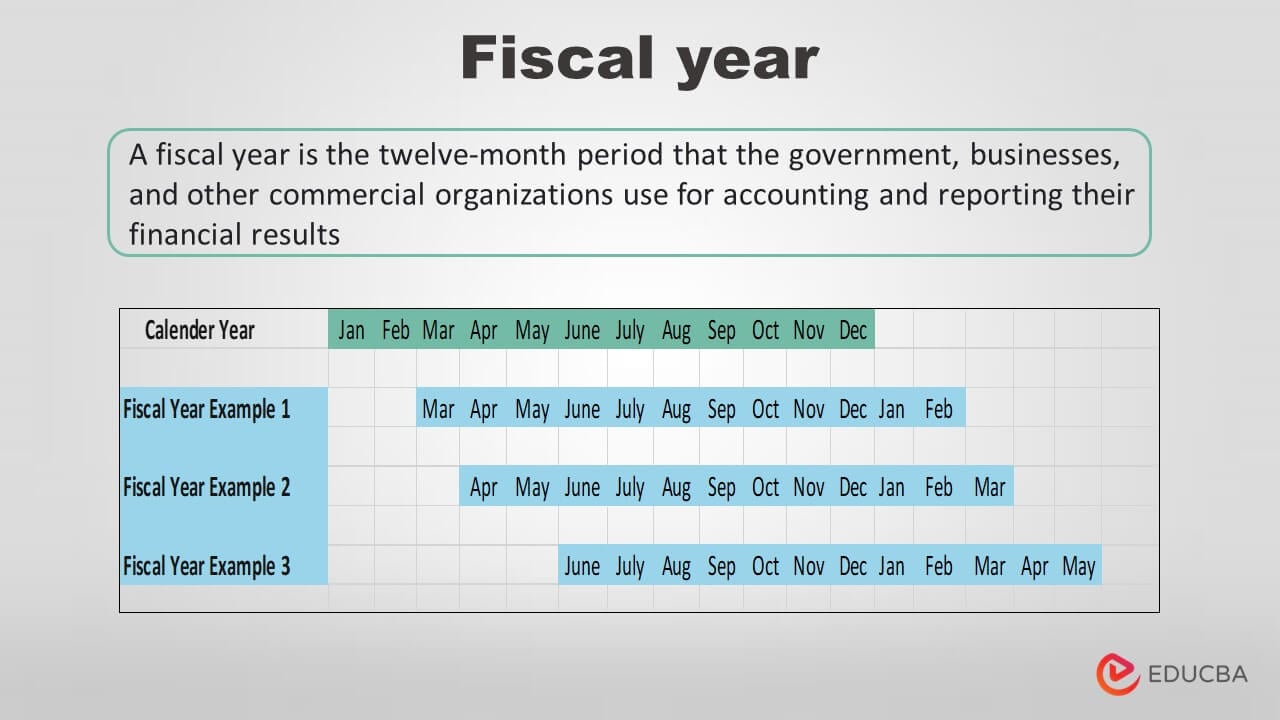

What Is A Fiscal Year Benefits Irs Guidelines Examples

What Exactly Is Cost Basis For A Traditional Ira

How To Buy Treasury Bonds And Buying Strategies To Consider

Roth Ira Basis What It Is How It S Calculated Restrictions

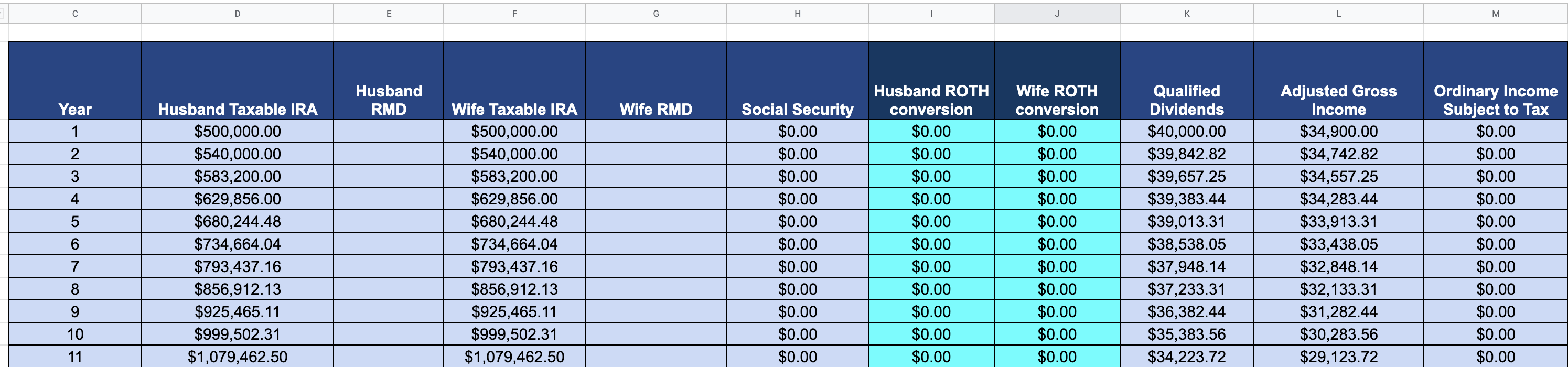

Roth Ira Conversions Aspen Creek Financial

How To Calculate The Taxable Amount Of An Ira Withdrawal Pocketsense

How To Analyze Roth Ira Conversions Seeking Alpha

How To Calculate Tax Free And Taxable Ira Withdrawals Kiplinger